Gone are those days when you had to wait for months before getting your loan file sanctioned. Today, all you need to do is use the internet and get in touch with any bank representative to get things done without standing in lines for hours on days together. All in all, it’s a great time if you wish to take a loan as you can easily know how much you’re eligible for and then proceed ahead accordingly.

Knowing Your Mortgage Loan Eligibility

Most of the people find it tough to deal with the stress caused by mortgage loans. They keep on trying for months without even knowing how much they can receive based on their past payments and creditworthiness. Due to this uncertainty, they’re left empty-handed at the last moment. In case you are looking forward to applying for a mortgage in the near future, then don’t follow this process. Instead, have clarity about your loan eligibility right from day one so that you don’t have any false hopes at any point.

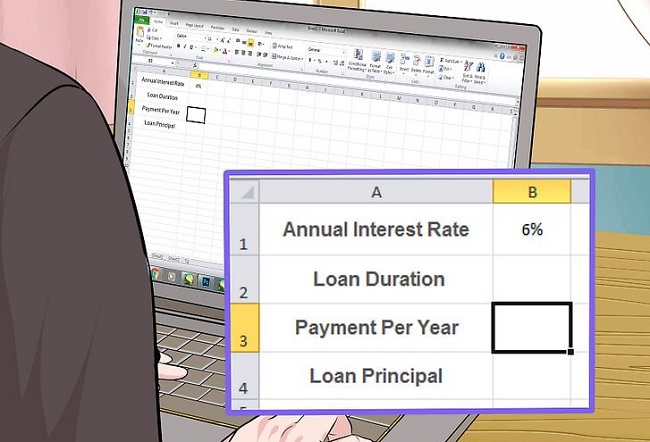

What you can do is use a useful mortgage calculator and enters the details it asks you for. Once you fill all the empty spaces, you can easily know how much amount you can be granted. The process is so hassle-free and straightforward that you don’t have to have any technical education for the same. Simply enter basic details like your name, past loans, age, salary/income, etc., and get the right information about eligible loan amount.

Typically, this process doesn’t take more than a few minutes, which means that you don’t have to block your entire day or week or month guessing the exact number that’s going to be sanctioned by the bank. When emergency situations hit life, and you have a clear idea about your loan eligibility, you can easily go ahead and search for other financing options in the market. This will not only keep you free from unnecessary troubles but also save you from the last moment problems.

Give it a shot and feel the difference.