When you are trading forex, you always keep close tabs on the changes in the trend. You do this because you want to get new opportunities. However, what happens is you only discover that the trend has changed after it has changed. And this has also been corroborated by various reviews like HQ Broker Review and FXempire Forex Review.

In this article, we’ll help you see the different patterns you should be looking for if you want to find forex trading trends.

Different Patterns

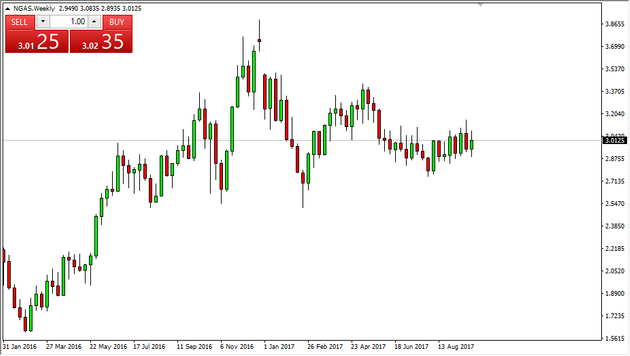

If you’re keen on utilizing chart patterns for your trade, you might find yourself looking at first at only a handful of candles. Then, once you get used to it, you start scrutinizing more patterns and charts.

Continuation

With only a generous amount of both knowledge and patience, you can make this your stable patterns. Continuation patterns are almost always present with a huge number of discretionary traders.

Japanese Candlesticks

Japanese sticks can be quite flexible. They’re very efficient if you use it by itself, and it becomes extremely invaluable if you use them with other tools like the moving average or a trend line. There are still many other tools that you can use with Japanese sticks, each with a varying level of effectiveness.

Triangles

Triangle or tribal patterns can be quite confusing in themselves but can help a trader after they’ve already finished. There are many kinds of triangles you may encounter while observing chart patterns, and you can use various ways to trade with them, though many traders fail to make the most out of them.

Sideways Consolidation

Even if you think that sideways consolidation is simple, you can be wrong. Many times, you can find that the market exceeds a new high, or beats the recorded historical high, only to find it developing a new relative low a couple of days after. Because of that, you ought to combine this pattern with the previous articles on price range extremes to help you figure if a trading opportunity is at hand.

Reversal Patterns

Reversal patterns are quite rare, which means that it should not be your base case scenario if you’re looking at a chart and seeing a developing pattern.

Head and Shoulders

If you’re a beginning trader, this is one of the first patterns that you will ever learn. You will learn not only the common names that we apply to them, but also the different things that these patterns imply.

Japanese candlesticks

Just like the Japanese candlesticks in the continuation pattern, the reversal Japanese candlestick pattern can be efficient enough on its own, but can be enhanced further by using it in conjunction with other pattern tools.

Double Top

Like the head and shoulder pattern, a double top can be the one of the first patterns that you will ever learn in trading. There will be instances where one double top can lead to an extensive reversal, though those events are quite rare.

Confirming the Change in the Trend

Whenever you suspect that a change in the pattern is going to take place soon, you should find ways to confirm that suspicion. You can use a variety of tools to accomplish this. Once a trend change is confirmed, you can then try to use it to your advantage and turn it into a profit making opportunity.